So, my question is this: now why the HELL would I want to do a silly thing like that?

I have a (thankfully) uninteresting history with credit cards, having consistenly paid off my balance on a monthly basis since I received my very first credit card at the age of 16. I guess I'm a really good customer because they keep upping my limit whether I want them to or not. This can come in handy (let's just say my limit is sufficient to pay for a semester's tuition all in one go and leave it at that), it's really easy to abuse if I don't have my head on straight.

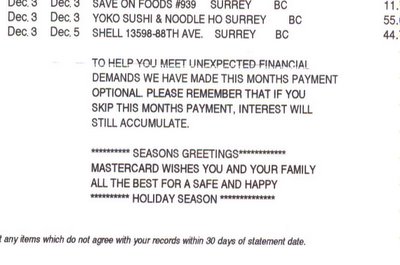

Stuff like this really tells me that credit companies do not have the best interests of the consumer in mind. I get one of these "payment optional" notices at least three or four times a year and in my opinion, it amounts to psychological mind games. Apart from the fact that your credit rating will likely take a hit, you will have to pay for interest in both cases. However, the effects of having your credit rating drop won't be felt immediately (unless you're planning on making a major purchase right away), whereas paying for interest is a little more immediate.

Interest payments are stupidly punishing. I remember paying off a Visa bill through the bank, but due to an error (on whose part, I don't know), the payment was shorted by $2. I was billed over $28 for interest payments, as the interest occured on the entire previous statement, not just the $2 owed. After enough complaining, the entire thing was reversed. Dumbasses.

Thursday, December 22, 2005

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment